Introduction

In this digital-first era, offering varied and smooth payment methods is not an added value—it’s a requirement for eCommerce companies. A shopper’s experience doesn’t conclude when they put items into their cart it keeps going until the checkout page. If your payment is slow, restrictive, or insecure, customers will abandon ship sometimes permanently.

As any experienced digital marketing agency in UK would confirm, over 70% of online shopping carts are left abandoned, with one of the biggest reasons being a lack of preferred Payment Options. Providing diverse, trustworthy, and locally suitable payment methods can directly enhance your conversion rates, build trust, and help your brand become more reputable.

Mobile commerce is also increasing. More than 60% of eCommerce traffic is via mobile as of 2025. Therefore, your payment system has to be mobile-friendly, quick, and user-friendly.

Here, in this guide, we will take you through the seven best payment methods to provide your customers, their advantages and disadvantages, and how to implement them on your store for optimal results.

Also Read – Stripe vs PayPal: Which Is Better for Your WordPress Site?

Why Offering Multiple Payment Methods Matters

Customers are not identical. They are from various countries, have varying banking systems, inclinations, and access to financial instruments. A US customer might prefer PayPal, whereas an Indian customer would prefer UPI. A German customer might prefer bank transfers (SEPA), whereas a Kenyan customer uses M-Pesa.

Following are some strong reasons for providing multiple Payment Options:

- Lowered Cart Abandonment: Insufficient preferred payment choices is one of the most important reasons for cart abandonment.

- Higher Trust: Providing familiar and secure payments instills trust.

- Globally Scaled: Varying regions have different ways of paying. Conforming to local payment patterns enables you to expand worldwide.

- Enhanced Customer Satisfaction: Providing payment flexibility to customers increases satisfaction.

- Increased Conversions: More choices lead to fewer objections at checkout, resulting in greater sales.

The 7 Best eCommerce Payment Methods

1. Credit/Debit Cards (Visa, MasterCard, etc.)

- Advantages: Accepted everywhere, quick processing, operates worldwide.

- Disadvantages: High fees, risk of fraud, chargebacks.

- Integration: Simple integration with payment gateways such as Stripe, Square, or PayPal Pro.

- Security: Employ PCI DSS compliance, tokenization, and 3D Secure.

2. Digital Wallets (PayPal, Apple Pay, Google Pay)

- Advantages: Fast checkout, increased security, increasing usage.

- Disadvantages: Not all users use wallets, region-specific availability.

- Integration: Easy plugins for most eCommerce platforms.

- Bonus: Wallets such as PayPal provide dispute resolution that builds buyer confidence.

3. Buy Now, Pay Later (BNPL) Services (Afterpay, Klarna)

- Pros: Appeals to younger buyers, increases cart value, simple approvals.

- Cons: Increases returns, third-party risk.

- Integration: Available as add-ons for Shopify, Magento, and WooCommerce.

- Tip: Keep returns and fraud in check with BNPL orders.

4. Bank Transfers & Direct Debit

- Pros: Low fees, secure, popular in the EU.

- Cons: Slower processing, less prevalent in North America.

- Integration: Pay with services like SEPA, iDEAL, or ACH.

- Use Case: Suitable for high-value items or B2B eCommerce

5. Cryptocurrency Payments (Bitcoin, Ethereum, etc.)

- Pros: International, irreversible transactions, increasing popularity.

- Costs: Volatile, fewer users, regulatory issues.

- Integration: Solutions such as BitPay, Coinbase Commerce.

- Note: Employ this if your target market is tech-savvy or foreign.

6. Mobile Payment Systems (UPI, M-Pesa, Alipay)

- Pros: Explosive growth in Asia and Africa, low cost, mobile-first approach.

- Cons: Unavailable worldwide.

- Integration: Razorpay for UPI, Flutterwave for African payments.

- Tip: A necessity if you’re selling to India, Kenya, or China.

7. Cash on Delivery (COD)

- Pros: Reliable in developing nations, low risk for consumers.

- Cons: High rate of returns, fraud, logistics complexity.

- Use Case: Suitable for customers with low online system trust.

- Strategy: Restrict COD on high-value purchases or new clients.

How to Integrate These Payment Methods Into Your Store

Integration is the most important thing. Even with the best Payment Options, if the integration is poor—slow, buggy, or confusing customers will fall off. Let’s walk through integration options for large platforms and best practices:

A. Shopify

- Integrated Gateways: Shopify integrates Stripe, PayPal, Shop Pay, Apple Pay, and local wallets.

- BNPL Integration: Klarna, Afterpay, and Affirm can be turned on through the Shopify Payments dashboard.

- Mobile Optimization: Shopify is mobile-responsive, but check third-party gateways for mobile UX.

- Customization: Limited but sufficient for most mid-level stores.

B. WooCommerce (WordPress)

- Plugin Ecosystem: Provides official plugins for PayPal, Razorpay, Stripe, Paytm, etc.

- Regional Support: UPI, Netbanking, M-Pesa, and more available through local plugins.

- Developer Friendly: Open-source, so custom integrations through APIs are a breeze.

- Security: Use plugins with frequent updates and good reviews only.

C. Magento

- Enterprise-Level Flexibility: Best for large-scale or international stores.

- Custom Gateways: Incorporate country-specific options such as iDEAL, Boleto, or Sofort through modules.

- Complex Setup: Best managed with a Magento development team.

D. API Integrations (Custom Websites)

- .Stripe: Provides APIs for cards, wallets, crypto, and recurring billing.

- .Razorpay: Best suited for Indian market with UPI, netbanking, wallet, and card support.

- .Flutterwave: Used in Africa for mobile wallets and bank transfers.

- .BitPay or Coinbase Commerce: For crypto transactions.

E. Best Practices

- A/B test checkout flows.

- Minimize number of steps (2–3 ideally).

- Auto-detect region and provide local Payment Options.

- Provide “save card” or “quick pay” for frequent customers.

- Always display trust badges (e.g. “Secured by SSL”).

Also Read – Ecommerce Payment Processing Guide: Top 7 Services and More

Common Mistakes to Avoid

Store owners often unknowingly commit mistakes that impact their checkout experience. Some of the key ones are:

1. Neglecting Mobile Experience

- More than 60% of online consumers use mobile devices.

- Non-responsive payment forms or slow-loading pages create frustration.

- Test your entire checkout process on multiple screen sizes and devices.

2. Providing Only One Payment Option

- If you provide only cards, you’re excluding wallets, BNPL, UPI, and mobile-first consumers.

- Customers in most geographies lack cards or don’t prefer using them online.

3. Hiding Costs at Checkout

- Surprising transaction charges or shipping charges at the final step turn people away.

- Make pricing and all additional fees clear and transparent upfront.

4. Not Leveraging Trust Signals

- No SSL certificate

- No payment trust badges (e.g., “Secured by Stripe” or “Verified by Visa”)

- No reviews/testimonials near checkout

- These cause users to worry about providing payment information.

5. Complex or Long Checkout Process

- More than 3 steps = higher abandonment rate.

- Keep fields to a minimum: name, email, shipping address, payment.

- Use autofill, guest checkout, and progress indicators.

6. No Support for Failed Payments

- If a transaction fails, display an informative error message and offer alternatives.

- Provide retry mechanisms or offload to support/chat.

7. No Multi-Currency or Multi-Language Options

- Worldwide customers prefer to view prices in their local currency.

- Implement services such as GeoIP to automatically detect location and propose currency.

Security and Compliance Considerations

Payments are a high-risk field for fraud, chargebacks, and data robbery. Shoppers want to feel confident their sensitive information is secure. You must be compliant with worldwide standards and disclose your security procedures.

1. PCI DSS Compliance (Payment Card Industry Data Security Standard)

- Mandatory if you store or process credit/debit card information.

- Use third-party processors such as Stripe or Razorpay to not store card information yourself.

2. SSL Certificates

- Encrypts data in transit.

- Necessary for displaying “HTTPS” in the browser bar.

- Some browsers now block checkout on non-HTTPS sites.

3. Tokenization

- Card numbers are substituted with random strings (tokens).

- Tokens are meaningless if intercepted by hackers.

- Stripe and PayPal use this as default.

4. 3D Secure (3DS2)

- Adds additional authentication (OTP or fingerprint).

- Now mandated under Strong Customer Authentication (SCA) in the EU.

- Minimizes fraud but may add friction unless optimized.

5. Anti-Fraud Systems

- Watch for unusual patterns (IP address discrepancy, high order value, etc.).

- Tools: FraudLabs Pro, Signifyd, Stripe Radar.

- Always check initial high-value orders.

6. Chargeback Management

- A chargeback = customer disputes payment → you lose the money.

- Provide detailed invoices and shipping proofs.

- Utilize PayPal/Stripe’s dispute resolution tools.

eCommerce Payments of the Future

The eCommerce payments landscape is changing fast. Here are the trends that are building the future:

1. Biometric Payments

- Fingerprint, facial recognition, or voice to authenticate payments.

- Already deployed with Apple Pay (Face ID) and Samsung Pay.

- Predicted to go mainstream because of enhanced convenience and security.

2. AI-Driven Risk and Fraud Detection

- AI algorithms can now identify unusual patterns in payment behavior.

- Dynamic rules are being replaced by real-time fraud detection tools.

- Reduces false positives (genuine customers getting flagged) and decreases fraud loss.

3. Blockchain and Decentralized Finance (DeFi)

- Lowers-cost, real-time cross-border payments.

- Smart contracts facilitate automatic refunds and escrow.

- Early days for widespread adoption, but niche groups are taking part.

4. Cross-Border Payment Solutions

- Growth of fintechs such as Wise (previously TransferWise), Payoneer, and Airwallex.

- Lower costs, faster currency exchange, and local payment acceptance.

5. Super Apps & Embedded Finance

- WeChat, Gojek, and Grab platforms integrate shopping, payments, and banking.

- Look for more platforms to integrate built-in wallets and credit.

6. Voice-Activated Payments

- Increasing usage through smart assistants such as Alexa, Google Assistant, and Siri.

- “Hey Siri, buy more detergent” → Checkout done.

- Security and verification are still evolving.

7. Green Payments & Sustainability

- New trend where customers opt for eco-friendly payment processors (carbon-neutral).

- Brands are beginning to display emissions details at checkout.

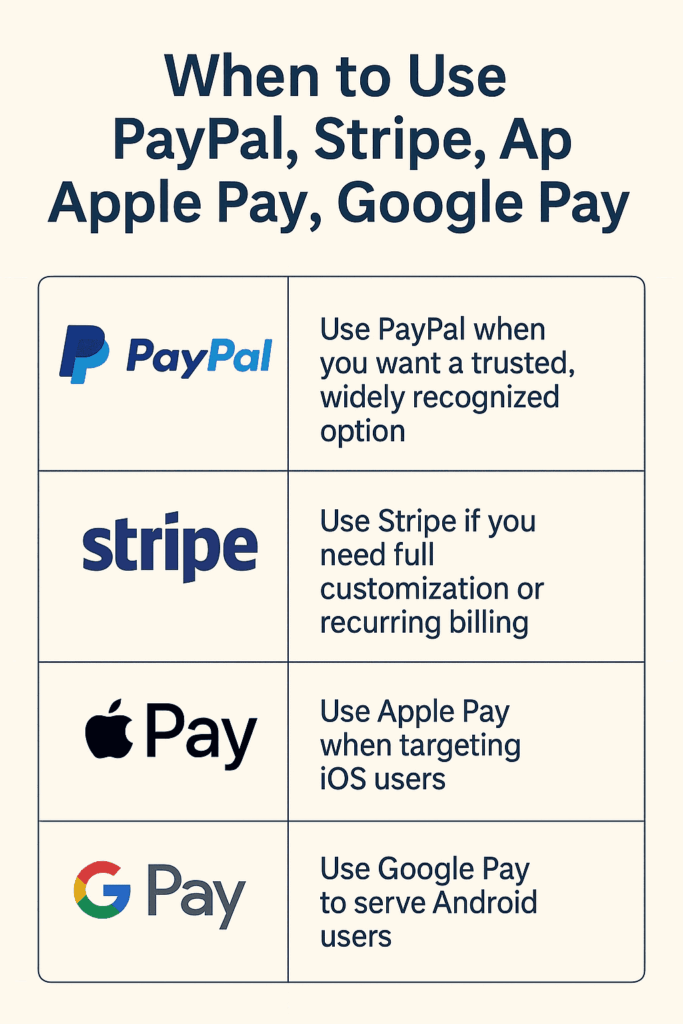

When to Use PayPal, Stripe, Apple Pay, and Google Pay

Choosing the right payment method depends on your business model, customer preferences, and technical needs.

- Use PayPal when you want a trusted, widely recognized option that appeals to international buyers and doesn’t require a credit card. It’s ideal for freelancers, small businesses, and global transactions.

- Use Stripe if you need full customization, recurring billing (subscriptions), or a seamless checkout experience on your website. It’s great for developers and SaaS businesses.

- Use Apple Pay when targeting iOS users who prefer quick, secure, one-click payments. It works well for mobile-first eCommerce and apps.

- Use Google Pay to serve Android users with fast, easy mobile payments. It’s particularly useful for businesses targeting a global or mobile-savvy audience.

Apple Pay Disadvantages

Here are some of the main disadvantages:

- Device Compatibility Is Limited

- Merchant Acceptance Not Universal

- Transaction Limits

- Dependent on Technology

- Privacy Issues

FAQs

Q: What is the safest payment method for eCommerce?

A: Electronic wallets such as PayPal and Apple Pay are generally the safest due to encryption and consumer protection.

Q: What is the most used payment method worldwide in 2025?

A: Mobile payments (such as UPI, Alipay) are gaining, particularly in Asia and Africa.

Q: How do I minimize cart abandonment at checkout?

A: Provide several known payment methods, minimize steps, and make it mobile-friend

Conclusion & Call to Action

The checkout experience is the final mile of your customer’s buying journey, but it’s also one of the weakest. Regardless of how amazing your products are or how beautiful your website is, a bad payment experience can cause immediate drop-offs and long-term loss of trust. As highlighted by experts offering digital marketing services in UK, optimizing this stage is crucial for maximizing conversions and retaining customer trust.

In this guide, we walked through the 7 most critical eCommerce payment methods—each with its own distinct strengths and applications:

- Credit/Debit Cards remain the most universal choice.

- Digital Wallets provide speed and trust.

- Buy Now, Pay Later (BNPL) solutions increase conversion and AOV.

- Bank Transfers are secure and well-liked in Europe.

- Cryptocurrency is gaining traction among tech-savvy users.

- Mobile Payment Systems rule markets such as India, China, and Africa.

- Cash on Delivery (COD) continues to be popular in low-trust or cash-based areas.

Providing multiple Payment Options is not a “nice-to-have”—it’s a key growth strategy:

- It minimizes cart abandonment.

- It establishes credibility with your consumers.

- It makes frictionless expansion possible globally.

- It aligns your business to 2025+ customer expectations.

Strategic Suggestions

- Begin with customer insights: Review your customers’ geographics, device behaviors, and activity. Use it to rank your Payment Options.

- Deploy in increments: Don’t bog down your checkout with too many options to start. Begin with 3–4 that are most well-used and branch out as demand warrants.

- Test and optimize: A/B test payment flows. Track what methods convert higher.

- Think regionally: Provide UPI in India, M-Pesa in Kenya, Alipay in China, etc.

- Stay compliant and secure: Payment security is not solely concerned with preventing fraud—it’s about establishing trust. Make PCI-DSS, SSL, tokenization, and anti-fraud tools requirements.

What Should You Do Next? (Call to Action)

Now that you know about the significance and deployment of contemporary payment systems, it’s time to act:

- Review your existing payment configuration: What options are lacking? Are there any that are outdated or unused?

- Speak with your developer or support team for your platform: Start integrating a minimum of 2–3 new options applicable to your users.

- Include trust badges and clear fee disclosures on your checkout pages.

- Track analytics for cart abandonment rates prior to and after modifications.

- Get feedback from your customers regarding their preferred Payment Options—through email or post-purchase survey.